Content Collections

Our curated collections of interactive financial content are designed to help you reach your goals on your own time, at any career stage.

Medical School Debt Repayment for Physicians

As a physician, you may still be managing medical school debt but it doesn't need to weigh you down. ...

How Long Does It Take to Pay Off Medical School Debt?

What is the Average Medical Student Debt?

Paying off Your Medical School Loans Part 1: Setting Yourself Up for Success

Paying Off Your Medical School Loans Part 2: Forbearance and Forgiveness

Navigating Student Loan Repayment: DOs and DON’Ts

Who Qualifies for Student Loan Refinancing?

Does Paying Off My Student Loans Impact My Credit Score?

Getting a Mortgage When You Still Have Student Loan Debt

Medical Student Loan Repayment

4 Reasons to Refinance Your Student Loans

Income-Driven Repayment (IDR) Income Limits

$1.2 Million Forgiven: How Two Doctors Found Student Loan Freedom

Season 3 Finale: Top Money Questions Answered by Our Experts

Savings Strategies for Residents

As a resident, building your savings may seem challenging but there are several strategies you can a ...

High Yield Savings Calculator

Maximize Savings and Minimize Risk with a High Yield Savings Account

Budgeting 101 for Physicians

Overcoming Financial Challenges During Residency

Quick Budgeting Tips for Doctors

Why Residents and Early Attendings Need to Budget

How Much Doctors Should Save for an Emergency Fund

How to Use Direct Deposit to Reach Your Savings Goals

Love + Money – How Complicated Is This Relationship?

Managing Lifestyle Creep

What Every Medical Resident Needs to Know About Lifestyle Creep

The Five Basics of Financial Success for Physicians

Savings Strategies for Physicians

Whether you're saving for an emergency fund, retirement, a down payment, or something else, here are ...

High Yield Savings Calculator

Maximize Savings and Minimize Risk with a High Yield Savings Account

How Much Doctors Should Save for an Emergency Fund

Budgeting 101 for Physicians

Quick Budgeting Tips for Doctors

How a Small Change in Your Loan Interest Rate Can Make a Big Difference

Why Residents and Early Attendings Need to Budget

5 Habits to Help Doctors Avoid Lifestyle Inflation

Investing for Doctors: Investment Fundamentals

Managing Your Finances as a Physician

As an attending physician, your hard work is paying off — literally. Learn to manage your money to ...

Doctor Money: Physician Finance Habits You Should Start Right Now

Love + Money – How Complicated Is This Relationship?

How Much Doctors Should Save for an Emergency Fund

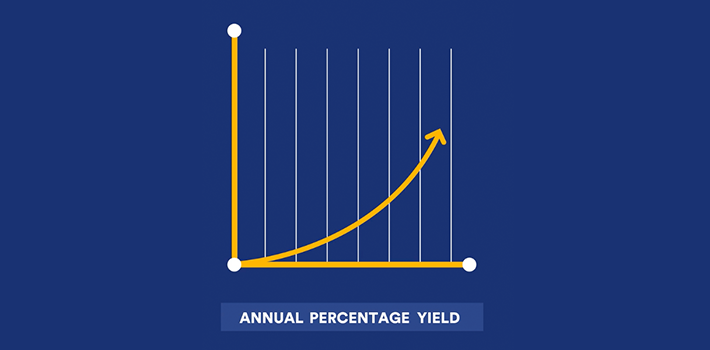

APR vs APY: What’s the Difference?

Life Insurance for Physicians

5 Habits to Help Doctors Avoid Lifestyle Inflation

The Five Basics of Financial Success for Physicians

Managing Medical School Debt for Residents

Student loan debt helped you become a doctor, but you don’t want it to weigh you down. Here are so ...

Managing Student Loans & Finances for Residents

Refinancing Options For Medical Residents

A Financial Planning Guide for Residency

Student Loan Forgiveness for Doctors: An Overview

4 Reasons to Refinance Your Student Loans

Paying off Your Medical School Loans Part 1: Setting Yourself Up for Success

Guide to Student Loan Consolidation

7 Jobs That Can Get Student Loan Forgiveness

How PSLF Can Help Doctors Serve Communities in Need

How Long Does It Take to Pay Off Medical School Debt?

Medical Student Debt: Consolidation or Refinancing

Paying Off Your Medical School Loans Part 2: Forbearance and Forgiveness

What is the Average Medical Student Debt?

How to Relieve Student Loan Debt Stress with Expert Guidance

Medical Student Loan Repayment

6 Student Loan Forgiveness Programs – Do You Qualify?

$1.2 Million Forgiven: How Two Doctors Found Student Loan Freedom

Your Last Year of Residency

You’re prepping for your boards and for the next step in your medical career. Where should you be ...

Preparing for Your First Year Out of Residency

Overcoming Financial Challenges During Residency

The Post-Residency Job Search

Relocating as a Doctor? Here’s What You Need to Know

7 Tips for Your First Year Out of Residency

Managing Student Loans & Finances for Residents

Doctor Money: Physician Finance Habits You Should Start Right Now

Breaking Barriers: LGBTQ+ Healthcare with Dr. James Kostek

When to Consider Paying Down Debt with a Personal Loan

Beyond the White Coat: Parenthood in the Medical Field

Planning for a Private Practice

When you're considering opening or buying into a private practice after residency, there's a lot to ...

The Pros and Cons of Starting Your Own Practice

Economics of Starting Your Own Practice

6 Reasons Doctors Should Consider Private Practice

7 Common Mistakes Made When Starting Your Own Practice

Buying Your Own Practice

Opening a Medical Practice Checklist

Breaking Barriers: LGBTQ+ Healthcare with Dr. James Kostek

Debt Management Strategies for Physicians

Managing debt as a physician can be complicated. This collection looks at strategies for taking cont ...

Medical Student Debt: Consolidation or Refinancing

A Guide to Student Loan Refinancing

4 Reasons to Refinance Your Student Loans

Love + Money – How Complicated Is This Relationship?

What’s Trending in Hospital Employee Benefits

Talking PSLF with Three Doctors Who Reached Student Loan Forgiveness

How to Refinance Your Student Loans

When to Consider Paying Down Debt with a Personal Loan

Student Loan Refinancing for Physicians

As a physician, you'll have several options when it comes to managing your student loans. If you can ...

A Guide to Student Loan Refinancing

Medical Student Debt: Consolidation or Refinancing

Who Qualifies for Student Loan Refinancing?

How to Refinance Your Student Loans

4 Reasons to Refinance Your Student Loans

Getting a Mortgage as a Resident

If you're ready to buy a home as a resident, explore some of the options available for doctors, lear ...

Mortgages for Doctors: What You Need to Know about Private Mortgage Insurance (PMI)

Why a Physician Mortgage Makes Sense at Different Career Stages

How Much of a Down Payment Do You Need to Buy a House?

Getting a Mortgage When You Still Have Student Loan Debt

Getting a Mortgage: What to Expect From Closing