How CRNAs Can Build a Financial Plan

For Certified Registered Nurse Anesthetists (CRNAs) looking to maintain both professional and personal growth, creating a solid financial plan will be critical to building long-term financial stability.

For Certified Registered Nurse Anesthetists (CRNAs) looking to maintain both professional and personal growth, creating a solid financial plan will be critical to building long-term financial stability. CRNAs are no strangers to the importance of making strategic decisions under enormous pressure. When it comes to addressing personal finances, using the same strategic decision-making skills will help you stay focused on reaching your targeted financial goals.

While CRNAs continue to have the highest salaries and earning potential among advanced practice registered nurses (APRNs), the trend toward even requiring more advanced degrees continues to present new challenges—including equally high student loan debt. Based on recommendations of COA, the credentialing body for nurse anesthetists, schools will be required to graduate only clinical doctorate educated CRNAs starting in the year 2025. However, current practicing CRNAs will not be required to obtain a doctorate. With these increasing educational requirements, student loan debt will continue to be a challenge for nurse anesthetists.

Whether you’re focused on paying off student loan debt or building investments for the future, here are eight steps you can take to create a solid financial plan.

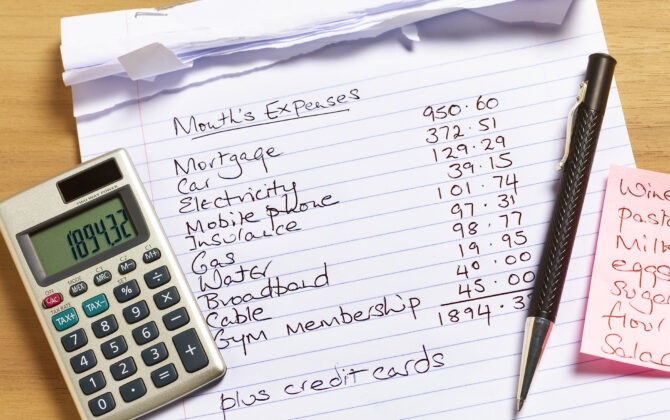

Audit & assess your budget

When it comes to beginning your financial plan, you’ll want to start by assessing your budget. Even as a higher earner, make sure that your spending is supporting your goals for savings, investments, and retirement. Given that many CRNAs are independent contractors, you’ll want to future-proof your budget based on your employment circumstances. Start with a detailed audit of your total income, total expenses, and your savings. The 50/30/20 budget is simple method to track and categorize your budget. This budget method sorts your expenses into three buckets — 50% for ‘needs,’ 30% for ‘wants,’ and 20% for ‘savings and investments.’ Watch this quick budget video for a preview of this budget rule or use our 50/30/20 budget calculator to get started.

Negotiate & refinance debt

After you have audited your total expenses, look to see how you can reduce your expenses or debts to free up more funds for your savings or investment goals.

For many CRNAs, this might mean focusing on student loan debt. Up to 92% of CRNAs will graduate with some student loan debt, with many facing up to $100,000 in student loans. When it comes to CRNA student loan repayment, make sure you explore all your repayment options including federal programs, such as Public Service Loan Forgiveness (PSLF). For private student loans, check if refinancing could help you lower your rate or monthly payment. To learn more about student loan repayment options for nurses, read more here.

When it comes to other bills and expenses, such as cable or internet, you may be able to negotiate to a lower monthly bill by contacting your provider. It’s also a good time to look at any subscriptions you may not need or could cancel to eliminate extra expenses.

Build an emergency fund

Most financial experts agree that you should allocate separate savings for an emergency fund, or “rainy day fund.” Having these funds set aside for the unexpected can help you make sure your other goals stay on track.

It’s typically recommended that you save 3-6 months of your current salary within your emergency fund, and as a CRNA you may decide you want to save even more depending on your job stability, or if you’re a 1099 independent contractor. While savings accounts are popular options for emergency savings, a high yield savings account can provide more favorable interest rates than those offered by traditional savings accounts, helping your emergency fund grow.

No matter what type of account you choose, these funds should be easily accessible, meaning you don’t have to pay penalties or go to great lengths to withdraw the funds quickly. Read more about the importance of an emergency fund here.

Take advantage of healthcare worker financial programs

With the growing focus on retaining and supporting medical professionals, some employers have started to expand sponsored programs, and offer different types of financial assistance. These programs might include student loan assistance or repayment programs, reimbursement for childcare or transportation, and referral or retention bonuses. If you haven’t already, explore all new and existing programs offered by your employer that can support your financial health.

In addition, many companies, lenders, and financial institutions have responded to support healthcare professionals with special offers or discounts and more flexible financial products and services. So, make sure you understand any special offers available to advanced practitioners.

Fund retirement savings & investments

Once you have tackled your budget, emergency savings, and any CRNA-advantaged programs, it’s time to look at your long-term investments, such as retirement.

Make sure you’re taking advantage of any employer-matching retirement programs if you’re eligible, including retirement benefits such as a 401(K), 457(b), 401(a), and Thrift Savings Plans (TSP) for federal employees, or other retirement funds.

Maximize your tax-advantaged contributions

First, make sure that you are taking advantage of pre-tax contributions through employer-sponsored programs, in addition to your private investments. Familiarize yourself with the annual contribution maximums of tax-advantaged accounts like IRAs and 401(k)s. In 2022, you can contribute a total of $6,000 to your IRAs, or $7,000 if you’re age 50 or older.

While most CRNAs have typically been ineligible to contribute directly to a Roth IRA based on their salaries, due to the CARES Act and recent legislation for pandemic-related income reduction, some CRNAs may qualify to either contribute or convert old retirement plans to a Roth IRA with less tax penalties. Consult a tax professional for more information on the most recent policies.

When it comes to your tax planning, CRNAs often experience a higher degree of income variability so you may need to work with your tax advisor earlier in the year to optimize your tax planning.

Consult a financial planning professional

Ideally, as a CRNA, you’ll want to seek out the advice of trusted financial professionals who have experience working with CRNAs and understand your unique challenges—from advanced degrees, to the credentialing process and even managing your student loans—and the unique advantages (and disadvantages) that go along with it.

When it comes to building a diverse and robust financial plan, a professional financial planner or advisor may be able to help you reach your goals more efficiently. When it comes to investing, there are many different investment types and strategies. There are also some fundamental concepts every investor should understand, including diversification, passive investing, performance chasing, and staying invested (even during periods of volatility). Diversification, for example, is a key investment strategy that involves diversifying your holdings among various asset classes and investment types. Diversifying can help manage volatility and mitigate investment risk, so you don’t “put all your eggs in one basket.” You’ll also want to make sure you understand your risk tolerance before meeting with a financial advisor.

Review & rebalance your financial plan annually

Finally, when it comes to your overall budget and financial plan, you’ll want to regularly review, evaluate, and rebalance your priorities and goals as needed. Particularly, if you have income changes or volatility, you should check in on your budget monthly, and your overall financial plan annually.

Above all, remember that financial planning should be a fluid and ongoing process that helps you get closer to financial freedom. Professional and economic factors are constantly evolving and working with a well-guided financial plan can ensure that you’re on track to build a bright financial future.

In providing this information, neither Laurel Road or KeyBank nor its affiliates are acting as your agent or is offering any tax, financial, accounting, or legal advice.

Any third-party linked content is provided for informational purposes and should not be viewed as an endorsement by Laurel Road or KeyBank of any third-party product or service mentioned. Laurel Road’s Online Privacy Statement does not apply to third-party linked websites and you should consult the privacy disclosures of each site you visit for further information.

Sources:

https://nurse.org/articles/15-highest-paying-nursing-careers/

https://nurse.org/education/crna-doctorate-degree-2025/

https://www.bls.gov/ooh/healthcare/nurse-anesthetists-nurse-midwives-and-nurse-

practitioners.htm

https://nurse.org/articles/crna-financial-planning-investing/

https://www.studentdebtrelief.us/resources/average-crna-salary

https://www.aacnnursing.org/Portals/42/Policy/PDF/Debt_Report.pdf

Don’t miss the latest financial resources.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Get tailored Laurel Road resources delivered to your inbox.

Search Results